Stacked Deck EV & Variance: When to Open, When to Sell?

By LootCalc Team · Published on 2025-10-20

Stacked Decks in Path of Exile represent one of the most analyzed currency decisions in the game: should you open them or sell them unopened? The answer lies in understanding both expected value (EV) and variance. While EV tells you the average long-term return, variance determines the risk you take on each session. This guide breaks down the mathematics, reveals market timing signals, and provides bankroll requirements to help you make risk-adjusted decisions that maximize profit without destroying your currency reserves during unlucky streaks.

For comprehensive Path of Exile optimization tools and strategies, visit the PoE Tools Hub. To understand statistical concepts referenced throughout this analysis, explore our Glossary covering expected value, variance, and standard deviation.

Understanding Stacked Deck Expected Value (EV) in Path of Exile

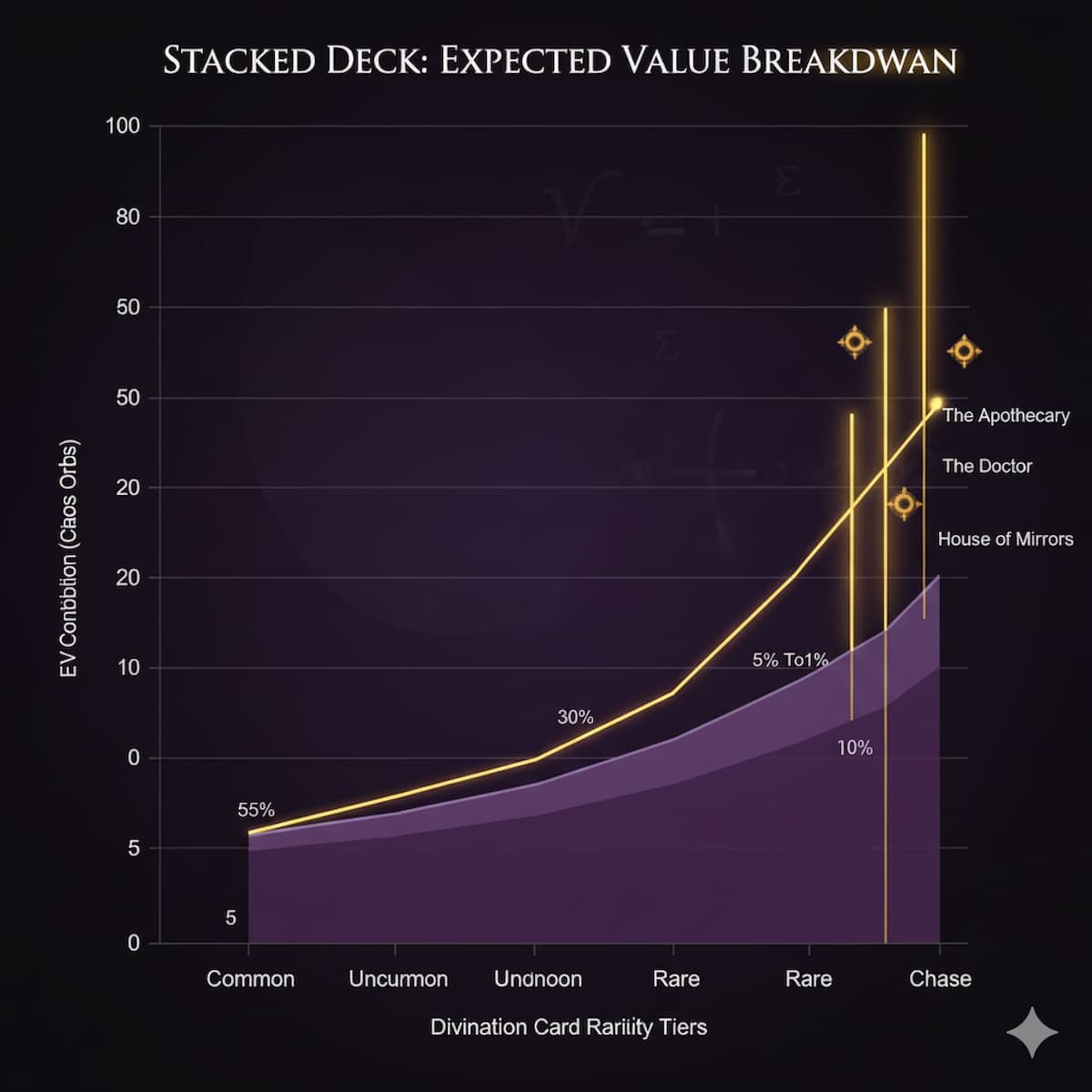

Expected Value (EV) is the average return per Stacked Deck over an infinite number of openings. In PoE, Stacked Deck EV equals the sum of each divination card's probability multiplied by its market value. The challenge is that the card pool contains hundreds of outcomes ranging from 1 Chaos commons to multi-Divine chase cards like The Apothecary, The Doctor, and House of Mirrors.

What Is Stacked Deck EV?

Stacked Deck EV represents the mathematical expectation of opening a single deck. If you open thousands of decks, your average return per deck should converge toward this number. However, variance ensures that any small sample—even 100 decks—can deviate wildly from the expected mean. Understanding both EV and variance is critical for making profitable decisions.

Card Pool Distribution & Rarity Weighting

Stacked Decks draw from the entire divination card pool using rarity-weighted probabilities. Common cards appear frequently but have minimal value. High-tier chase cards appear rarely but contribute substantial EV through their extreme prices. This creates a long-tail distribution where a small number of outcomes dominate total EV despite representing less than 1% of drop probability. For broader PoE currency optimization strategies, see our PoE Currency Profit Math guide.

High-Value Chase Cards Impact on EV

Cards like The Apothecary (Mageblood set), The Doctor (Headhunter card), and House of Mirrors contribute disproportionate EV despite their minuscule drop rates. For example, if a card worth 200 Divine has a 0.01% drop rate, it contributes 0.0001 × 200 = 0.02 Divine to the deck's total EV. Multiply across dozens of high-value cards, and this long-tail effect can dominate half or more of a deck's expected value.

Market Volatility Effects on Card Values

Card prices fluctuate throughout a league due to supply shocks, build meta shifts, and time decay. Early league, chase cards command premium prices due to scarcity. Late league, oversupply and player exodus crater values. This means Stacked Deck EV is not constant—it shifts week to week. Track current prices using live currency calculators to ensure your EV assumptions remain accurate.

How to Calculate Stacked Deck EV

To calculate Stacked Deck EV manually, sum the product of each card's drop probability and current market value. In practice, most players use community-maintained spreadsheets or tools that aggregate trade API data. The general formula is:

EV_deck = Σ(p_i × value_i) for all cards iWhere p_i is the probability of obtaining card i and value_i is its current Chaos or Divine value after trading fees. For step-by-step probability modeling, read our Drop Math & Binomial Distribution guide.

Real-World EV Examples from Current League

As of mid-league in recent PoE economy snapshots, Stacked Deck EV typically ranges from 4–8 Chaos depending on chase card prices. When unopened Stacked Decks trade at 5 Chaos, opening them yields slight positive EV but introduces significant variance. When decks cost 7+ Chaos, selling unopened often becomes the superior risk-adjusted play unless you have a massive bankroll to absorb dry streaks.

Variance in Stacked Deck Outcomes: Why Risk Matters as Much as EV

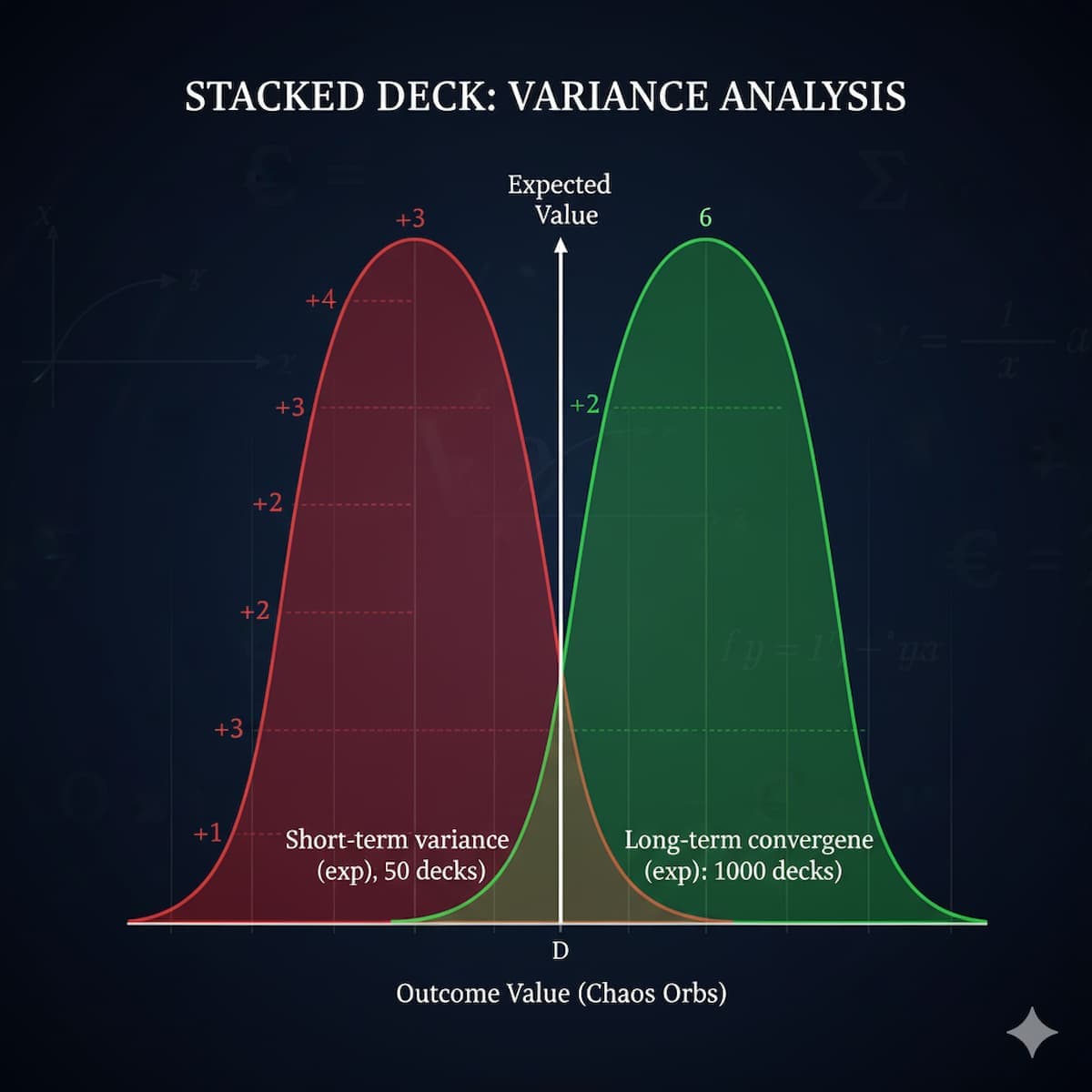

Variance measures the spread of outcomes around the mean. In Stacked Decks, variance is massive because of the long-tail card distribution. You can open 100 decks and get all commons, losing significant currency. Or you can hit a single Apothecary and recover 50+ decks worth of value instantly. This volatility means EV alone doesn't tell the whole story—you need to understand your risk exposure.

Why Variance Matters More Than EV

Two strategies can have identical EV but vastly different variance profiles. Low-variance strategies produce predictable, incremental gains. High-variance strategies swing wildly session to session. For players with limited bankrolls, high variance can lead to ruin even when the underlying EV is positive. This is why professional gamblers and traders use risk-adjusted metrics like the Kelly Criterion to size their bets.

Short-Term vs Long-Term Results

In the short term (10–100 decks), variance dominates. You might experience brutal dry streaks or jackpot windfalls that bear no relation to EV. In the long term (1000+ decks), the law of large numbers kicks in and your actual results converge toward expected value. Most players operate in the short-to-medium term, where variance is the primary driver of session outcomes. For detailed variance analysis across loot systems, see our Drop Rate Math guide.

Sample Size Requirements for Convergence

To achieve statistical confidence that your results reflect true EV rather than variance, you need large sample sizes. For Stacked Decks with extreme long-tail distributions, 500–1000 deck openings are the minimum for reasonable confidence intervals. Opening 50 decks and declaring "opening is better" or "selling is better" is statistically meaningless—your sample is dominated by noise.

High Variance vs Low Variance Strategies

High variance strategy: Open all decks. Accept wild swings. Potential for massive jackpots but also catastrophic dry streaks. Requires deep bankroll.

Low variance strategy: Sell all decks unopened. Guaranteed immediate liquidity. No upside, no downside. Predictable returns.

Hybrid strategy: Open when EV exceeds cost by 20%+ and you have 300+ deck sample size budgeted. Otherwise sell. This balances upside capture with downside protection.

Bankroll Requirements for Each Approach

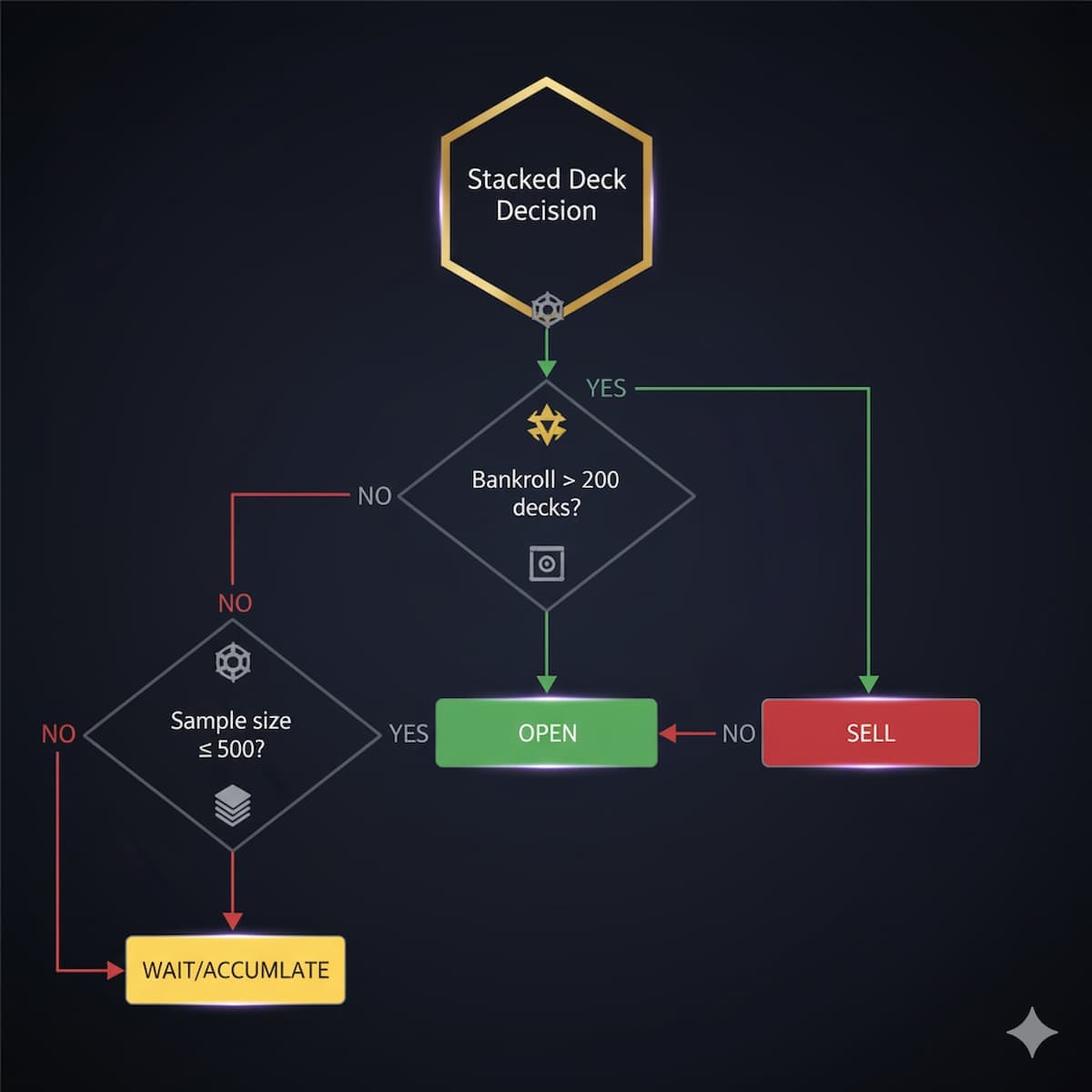

Opening Stacked Decks requires a bankroll buffer to survive variance. A common rule: maintain currency reserves equal to at least 200 deck purchase costs. If decks cost 5 Chaos each, keep 1000 Chaos liquid. This ensures you can weather 2–3 standard deviation dry streaks without forced liquidation. For risk management frameworks, see our EV vs GPH optimization guide.

When to Open Stacked Decks: Market Conditions & Risk Tolerance

Opening Stacked Decks becomes optimal when calculated EV exceeds unopened deck market prices by a meaningful margin (20%+ recommended), chase card prices are high and stable, and you possess sufficient bankroll to absorb variance over hundreds of openings. This section outlines the specific conditions that favor opening over selling.

Optimal Market Conditions for Opening

Open Stacked Decks when:

- Chase card prices are elevated (early league, meta shift demand spikes)

- Unopened deck prices are depressed relative to card pool EV (oversupply events)

- You have access to bulk deck acquisition at below-market rates

- League mechanics or patch changes boost high-value card drop rates

- You can commit to opening 500+ decks to smooth variance

Chase Card Price Thresholds

Track key cards like The Apothecary, The Doctor, and Seven Years Bad Luck. When their combined contribution to Stacked Deck EV exceeds 50% of total expected value and prices remain stable for 3+ days, opening becomes favorable. If prices crash due to oversupply or meta shifts, immediately pivot to selling unopened. For live market tracking, use PoE currency profit calculators.

Bankroll and Risk Tolerance Guidelines

Never open Stacked Decks if you can't afford to lose 30% of your invested capital over a single session. Variance can produce brutal dry streaks lasting 200+ decks. The recommended bankroll is:

- Conservative: 300× deck cost in liquid reserves (e.g., 1500 Chaos for 5c decks)

- Moderate: 200× deck cost in liquid reserves

- Aggressive: 100× deck cost minimum (not recommended for most players)

When to Sell Stacked Decks Unopened: Liquidity & Market Timing

Selling Stacked Decks unopened eliminates variance, provides instant liquidity, and frees up capital for other strategies. This approach is optimal when unopened deck prices are inflated, card pool EV is depressed, or when you lack the bankroll to safely absorb opening variance.

Market Timing Signals for Selling

Sell unopened Stacked Decks when:

- Unopened deck prices exceed calculated EV by 10%+ (market inefficiency)

- Chase card prices crash or enter sustained downtrend

- League is entering final weeks (demand collapse imminent)

- You need immediate liquidity for other investments or purchases

- Your bankroll can't sustain 200+ deck sample sizes safely

For broader currency trading strategies, explore our PoE Mapping & Stacked Deck Profit Guide.

Liquidity Advantages of Bulk Selling

Unopened Stacked Decks are highly liquid—bulk buyers exist at all league stages. Selling 100+ decks takes minutes compared to hours of card-by-card liquidation after opening. This time efficiency translates directly to superior gold per hour (GPH) when factoring in trading overhead. If your time has value, the liquidity premium of selling unopened often outweighs small EV advantages from opening.

FAQ: Stacked Deck EV, Variance & Opening Strategy

Should I always open Stacked Decks if EV is positive?

No. Positive EV doesn't guarantee profit in small samples. Variance can produce long losing streaks even when the math is favorable. Only open if: (1) EV exceeds cost by 20%+, (2) you have 200+ deck bankroll reserves, and (3) you can commit to 500+ deck sample sizes. Otherwise, sell unopened to avoid variance risk.

How many Stacked Decks do I need to open to see "average" returns?

Due to the long-tail distribution of high-value cards, you need 500–1000 openings to approach statistical confidence. Opening 50–100 decks proves nothing—your results are dominated by variance noise. Track results over large samples before drawing conclusions about opening vs selling profitability.

What's the biggest mistake players make with Stacked Decks?

Opening with insufficient bankroll. Players see positive EV, open 50 decks, hit a dry streak, lose 30% of their currency, panic sell, and conclude opening is unprofitable. In reality, they simply didn't respect variance. Proper bankroll management is non-negotiable for opening strategies.

Can I reduce variance by opening Stacked Decks in bulk sessions?

Bulk opening doesn't reduce variance—it just consolidates it into one session. Opening 1000 decks in one sitting has the same variance as opening 10 sessions of 100 decks each. What matters is total sample size, not session structure. However, bulk sessions reduce trading overhead and improve time efficiency.

When should I sell Stacked Decks during a league?

Sell when unopened deck prices spike above calculated EV (league start scarcity, supply shocks), when chase card prices enter sustained decline (late league saturation), or when you need immediate liquidity without variance exposure. Monitor price trends daily—markets move fast in PoE.

Conclusion: Risk-Adjusted Decisions for Stacked Deck Profit

The Stacked Deck open-vs-sell decision isn't about finding a universal answer—it's about matching strategy to market conditions, bankroll depth, and risk tolerance. Players who blindly follow "always open" or "always sell" rules leave profit on the table or bankrupt themselves through variance. The optimal approach is dynamic: calculate current EV, assess your bankroll capacity, monitor market trends, and adjust continuously.

Core Principles for Stacked Deck Strategy

- Respect variance. Positive EV means nothing without proper bankroll management.

- Track current prices. EV shifts weekly—outdated assumptions destroy profit.

- Commit to sample size. 50 decks proves nothing; 500+ starts mattering.

- Value liquidity. Time spent trading has cost—factor it into GPH calculations.

- Adapt constantly. League economies shift fast. Yesterday's optimal play is today's trap.

For comprehensive Path of Exile profit optimization across mapping, currency trading, and loot strategies, explore our full suite of PoE tools and guides. Understanding Stacked Deck variance is just one piece of the broader currency optimization puzzle.

Related Reading

- PoE Currency Profit Calculator — Real-time EV calculations for Stacked Decks and other currency items

- PoE Currency Profit Math: EV, GPH & Route Tables — Comprehensive guide to currency economics and mapping profit

- PoE Mapping & Stacked Deck Profit Guide — Detailed mapping strategies for Stacked Deck farming

- Drop Rate Math: EV, GPH & Variance — Statistical foundations for loot analysis across all games

- Drop Math: Binomial Distribution & Union Probability — Advanced probability modeling for rare drop events

- EV vs GPH: Optimize Time — When to prioritize hourly income over per-action value

- Glossary — Definitions for EV, variance, standard deviation, and other key terms