PoE Currency Profit Math: EV, GPH & Mapping Route Tables

By LootCalc Team · Published on 2025-10-18

Path of Exile (PoE) currency trading and mapping economics boil down to two fundamental questions: how much value does each action produce (EV) and how fast do those actions convert into profit per hour (GPH). This comprehensive guide connects both layers with transparent equations, practical route comparison tables, and actionable strategies. You'll learn how to price Stacked Decks, scarabs, compasses, and determine when it's smarter to sell currency rather than run it in maps.

For a broader view of Path of Exile optimization tools and calculators, see the PoE Tools Hub. To understand core statistical concepts referenced throughout this guide, explore our Glossary covering variance, expected value, and confidence intervals.

PoE Currency Price Modeling: Understanding Expected Value (EV)

Expected Value (EV) measures the average return of an action over many trials. In Path of Exile currency mathematics, EV represents the sum of outcome probabilities multiplied by their payoffs, minus costs and fees. While market volatility constantly affects prices, EV anchors your decisions in mathematical reality rather than emotional reactions to lucky screenshots or unlucky dry streaks.

The Core EV Formula for Path of Exile Drops

Suppose an item has a p% chance to drop and sells for V Chaos after trading fees and slippage. The contribution to your session EV is (p × V). Summing across all possible outcomes gives your total expected value per action. The challenge in PoE is that long-tail outcomes—such as high-tier divination cards from Stacked Decks or rare unique drops—contribute substantial EV but introduce massive variance into your actual results.

Long-Tail Drop Rates and Variance Management

Sessions can swing wildly even when your underlying math is positive. A 1% chance at a 10 Divine item contributes significant EV but won't materialize in most 100-action samples. Understanding this relationship between EV and actual session results is critical for bankroll management and strategic planning. For detailed analysis of variance in loot systems, read our drop rate math guide.

Price Snapshots, Market Overrides & Trading Slippage

Use league-wide price snapshots as your baseline EV calculation, then apply overrides based on your actual sell speed and observed slippage. Slow-moving unique items with limited liquidity should be discounted 15–30% from list price. Bulk currency with deep order books (like Chaos Orbs, Divine Orbs, or common scarabs) can use near-spot pricing. Always subtract listing fees and expected undercut slippage to avoid systematically overestimating your EV—a common trap that makes unprofitable strategies appear viable.

Market Liquidity Tiers

- Tier 1 (Instant): Chaos, Divine, Exalted, common scarabs — use 95%+ of spot price

- Tier 2 (Fast): Popular uniques, crafting materials — use 85–90% of spot

- Tier 3 (Slow): Build-specific items, niche bases — discount 70–80%

- Tier 4 (Illiquid): Legacy items, unpopular uniques — discount 50–60% or ignore

Time Cost of Trading

EV calculations must account for time investment. If an item requires 20 minutes of whispers, price adjustments, and trade window time, that time cost can completely erase paper EV when factored into your hourly rate. This is why optimizing for bulk-sellable currency streams often outperforms chasing slightly higher EV strategies with terrible liquidity.

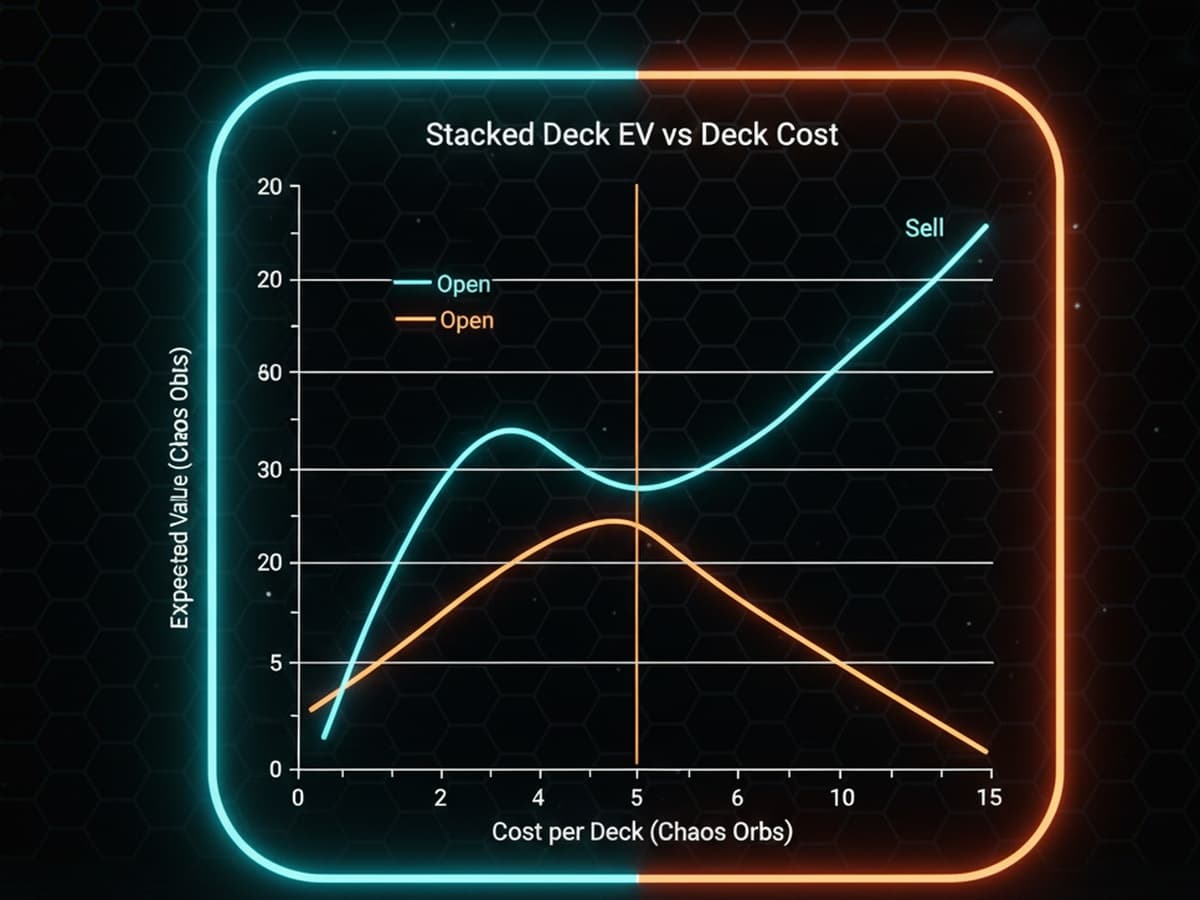

Stacked Decks: The Classic Sell vs Open Decision

The quintessential PoE currency decision: should I open Stacked Decks or sell them unopened? When deck market prices are high relative to the divination card pool EV, selling decks unopened often yields better risk-adjusted returns. Conversely, when the card pool includes multiple chase items (The Apothecary, The Doctor, etc.) and supply is limited, opening may win—but with significantly higher variance.

Stacked Deck EV Breakeven Analysis

Calculate the deck opening EV by summing (card probability × card value) across the entire divination card pool. Compare this to the current market price for unopened decks. The breakeven curve shifts with three factors:

- Deck acquisition cost (maps, juice investment, or direct purchase price)

- High-value card prices (Mageblood, Headhunter, mirror shard sets)

- Your personal variance tolerance and bankroll depth

When to Sell Decks

Sell unopened when: deck prices are inflated (league start, supply shocks), card pool EV is depressed (chase items nerfed or oversupplied), or you need immediate liquidity without variance risk. For more on the relationship between immediate returns and variance, see our EV vs GPH optimization guide.

When to Open Decks

Open when: calculated EV exceeds deck cost by 20%+ (margin for error), you have sufficient bankroll to absorb dry streaks (500+ deck samples recommended), and card prices are stable or rising. Track your actual results over large samples—variance means 100 decks proves nothing; 1000+ decks starts approaching statistical significance.

Gold Per Hour (GPH) vs Time Cost: Mapping Economy Fundamentals

GPH (gold/Chaos per hour) converts per-action EV into hourly income throughput. If one map consumes t minutes and produces expected value of E Chaos, then GPH ≈ (60 × E) / t. This formula reveals why optimizing for EV per map while ignoring time per map is a trap—any travel, setup, or trading overhead increases t, dragging GPH down even when your per-map EV looks impressive on paper.

The Critical Components of Mapping Profit Models

Building an accurate profit model requires tracking six core inputs with precision. Many players guess at these numbers and wonder why their strategies underperform—the math is unforgiving when your assumptions are wrong.

Essential Mapping Inputs

- Cost per Map: Base map + scarabs + sextants + compasses + fragments + Vaal orbs

- Time per Map: Clear time + portal/travel + boss time + loot sorting + trade interruptions

- EV per Map: Expected returns from all sources (monsters, chests, altars, strongboxes, essences, league mechanics)

- Sell-Through Rate: Percentage of drops you can bulk-sell within 5 minutes

- Variance Buffer: Bankroll required to survive 2–3 standard deviation dry streaks

- Opportunity Cost: What else could you be doing with this time and capital

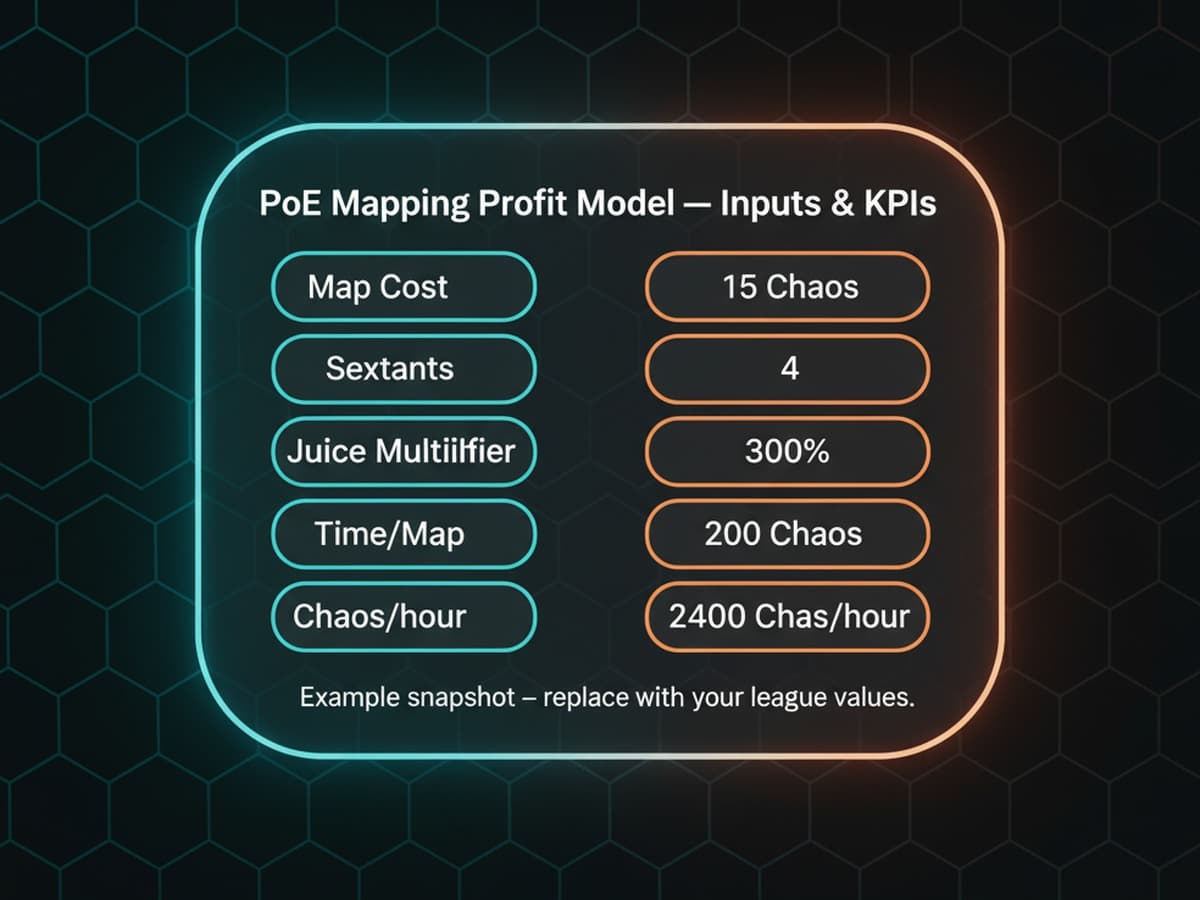

Worked Example: Low Budget vs Hyper-Juice Strategies

A low-budget Strand farming setup with minimal scarabs might complete in 2:00 per map with 40c expected value, yielding ~1,200c/hour (10d/hr). A hyper-juiced Crimson Temple with full compasses, Delirium orbs, and Winged Scarabs might produce 180c EV per map but take 4:30 to complete, yielding only ~2,400c/hour (20d/hr). The hyper-juice strategy has 4.5× the EV per map but only 2× the GPH due to time scaling.

When Does Juice Investment Pay Off?

Juice becomes profitable when the marginal EV gain exceeds the marginal time cost plus the juice cost itself. For most players, there's a sweet spot around mid-tier juice (Polished/Gilded scarabs, selective compasses) where returns are strong but map times remain manageable. For detailed route analysis, see our PoE Mapping & Stacked Deck Profit Guide.

Juice Tier Recommendations

- Beginner (50–100c budget): Rusted scarabs, basic sextants, alch & go

- Intermediate (300–500c budget): Polished scarabs, selective compasses, fragments

- Advanced (1–2d budget): Gilded scarabs, multiple compasses, Vaal orbs, beyond

- Hyper-juice (5–10d+ budget): Winged scarabs, full compass suite, Delirium orbs, MF gear

Atlas Passive Tree Synergies and Bottlenecks

Your Atlas passive tree determines which strategies are viable. A tree optimized for Expedition won't support Essence farming efficiently. Each respec costs 20 Orbs of Regret minimum—make informed choices before committing. The most profitable trees consolidate loot into 2–3 high-value streams (like Expedition + Legion + Essence) rather than spreading points across six mediocre mechanics.

High-Synergy Atlas Combinations

- Expedition + Ritual: Both generate high-value deferred/reroll opportunities with minimal time overhead

- Legion + Beyond: Density stacking for MF builds and incubator farming

- Essence + Harbinger: Guaranteed currency with low variance

- Delirium + Blight: High juice for experienced players with strong builds

Stacked Deck EV, Scarab ROI & Compass Cost-Benefit Analysis

Treat each consumable as an independent line item in your profit equation. If a sextant adds ΔE expected value and costs C Chaos, the net contribution to GPH is positive only when (60 × ΔE / t) > C / t after accounting for any time impacts. Some compasses add significant EV but slow maps by 30–60 seconds—factor their time overhead into t before assuming profit.

Scarab ROI Calculation Framework

To determine if a scarab is worth using, compute the marginal EV it adds through the mechanic it unlocks (more altars, additional essences, extra chests, etc.), then subtract both the currency cost and any time penalty. GPH improvement—not EV increase—is the final arbiter of value.

Scarab Efficiency Ranking

- S-Tier (Always use): Divination, Breach (if speced), Expedition (high ROI, minimal time)

- A-Tier (Usually profitable): Legion, Harbinger, Essence (good returns, manageable time)

- B-Tier (Situational): Beyond, Ambush, Torment (build/map dependent)

- C-Tier (Often skippable): Blight, Metamorph (high time cost for mediocre returns)

Compass Selection and Stacking Strategies

Compasses offer powerful modifiers but come with two costs: purchase price and potential time increase. The best compasses add pack size, item quantity/rarity, or extra mechanics without significantly lengthening maps. Avoid compasses that spawn slow bosses or force backtracking unless the EV gain is enormous (3–5× cost minimum).

High-Value Compass Modifiers

- +30–40% Pack Size (universal value across all strategies)

- Additional Legion/Expedition encounters (if tree-speced)

- Increased item quantity/rarity (especially for MF builds)

- Guaranteed strongbox types (Diviner's, Cartographer's)

- Extra altar chances (when running Eater/Exarch content)

Deck EV Sensitivity to Market Shifts

Stacked Deck EV fluctuates with card pool prices and deck acquisition cost. Use the breakeven curve analysis to inform your sell-vs-open decisions in real-time. When in doubt about holding risk, move inventory quickly—capital stuck in unsold cards is capital not earning returns. This principle applies broadly across all loot-based games.

Market Timing Principles

- Buy juice during oversupply (weekends, patch drops, league start +2 weeks)

- Sell high-value uniques during scarcity (mid-week, build meta shifts)

- Liquidate before league end (last 2 weeks see 30–50% price crashes on most items)

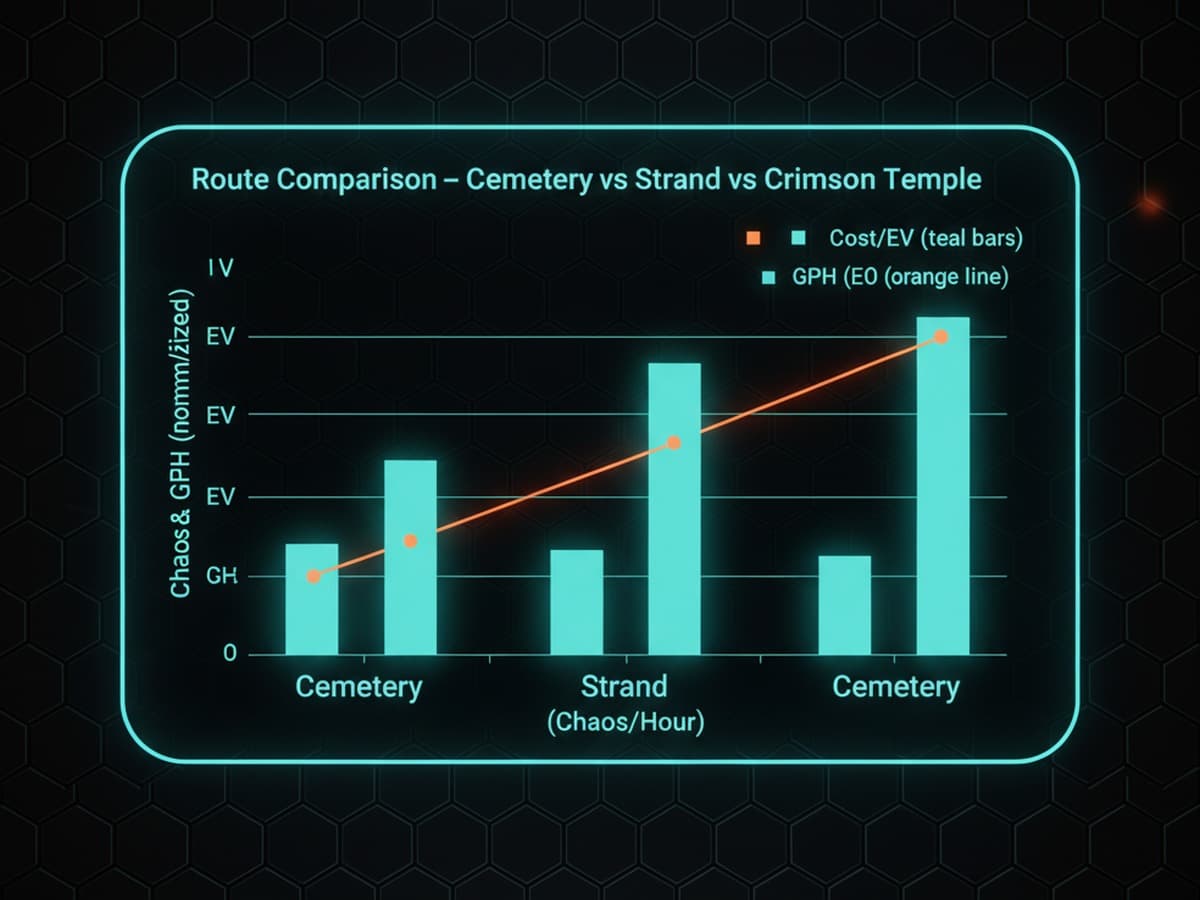

Route Comparison Tables: Cemetery vs Strand vs Crimson Temple

Different maps offer distinct trade-offs in layout efficiency, density, boss mechanics, altar frequency, and drop bulkability. The comparison table below illustrates how cost structure, expected value, and gold per hour can cross depending on your build's execution speed and juice tier.

Understanding Route Variables

- Layout: Linear maps (Strand) favor speed; dense maps (Cemetery) favor juice

- Boss Time: Easy bosses add minimal overhead; tough bosses can cost 30–60s

- Divination Card Pool: Some maps have exclusive high-value cards (Cemetery)

- Natural Density: Higher base density multiplies juice investment returns

Route Selection by Build Archetype

Fast clear builds (bow, wand) excel on linear maps like Strand and Toxic Sewer. Tanky, slow builds perform better on high-density maps where juice multipliers compensate for clear speed. Boss killers should prioritize maps with valuable guardian drops or influenced item bases.

Cemetery Route Analysis

Cemetery offers excellent divination card drops (The Nurse, The Saint's Treasure) and high natural density. The layout is compact but not linear—suits tanky clear builds. Boss time is moderate. Best for Divination scarab stacking and Ritual farming.

Strand Route Analysis

Strand is the gold standard for speed farming: perfectly linear layout, minimal backtracking, trivial boss. Lower natural density means juice investment has diminished returns, but raw maps per hour compensates. Ideal for low-juice, high-volume strategies and players who value consistency over peak map EV.

Crimson Temple Route Analysis

Crimson Temple combines good density with a valuable divination card pool (The Offering, The Apothecary from certain mechanics). Layout requires some backtracking. Boss is straightforward. Excels with mid-to-high juice investment and Divination scarabs. For detailed mathematical modeling of these routes, see our complete EV vs GPH guide.

Advanced Currency Math: Variance, Bankroll, and Risk Management

Understanding the mathematics is only half the battle—applying it sustainably requires proper bankroll management and variance tolerance. Even strategies with strongly positive long-term EV can bankrupt unprepared players through unlucky short-term sequences.

Bankroll Requirements for Common Strategies

- Low variance (Essence, Expedition): 20–30 map costs in reserve

- Medium variance (Legion, Ritual): 50–75 map costs in reserve

- High variance (Delirium, Stacked Decks): 100–200 map costs in reserve

- Extreme variance (MF Unique hunting): 500+ map costs or don't attempt

The Kelly Criterion Applied to PoE

The Kelly Criterion suggests betting a fraction of your bankroll proportional to your edge divided by your odds. In PoE terms: if a strategy has 10% positive EV with 2:1 variance, bet no more than 5% of bankroll per map cycle. This prevents ruin during inevitable dry streaks. For the mathematical foundations, read our drop math and binomial distribution guide.

Common Mistakes in PoE Currency Optimization

- Mistake #1: Optimizing EV while ignoring GPH (the time trap)

- Mistake #2: Under-reserving for variance (the bankroll trap)

- Mistake #3: Using retail prices in EV calcs instead of bulk/liquid prices

- Mistake #4: Failing to track actual results and adjust models

- Mistake #5: Chasing meta strategies that don't match your build or playstyle

FAQ: PoE Currency Math, Stacked Decks & Mapping Profit

What's the fastest way to calculate if a scarab is worth using?

Quick method: estimate how much extra loot the scarab generates on average (in Chaos), divide by the map time increase it causes (in minutes), multiply by 60 to get hourly value, then compare to the scarab's cost. If the hourly value exceeds cost by 2–3×, it's likely profitable.

Should I always open Stacked Decks for maximum EV?

Not necessarily. While opening decks often has slightly higher EV than selling unopened, it comes with much higher variance and requires larger bankrolls. Sell unopened when you need immediate liquidity, when deck prices are inflated, or when you can't sustain the variance. Open when you have 500+ decks to smooth variance and card prices are favorable.

How much currency should I budget for mapping before I start seeing profit?

Plan for 20–50 maps worth of juice costs as your initial investment before expecting net positive returns. Low-juice strategies need less (20–30 maps), high-juice strategies need more (50–100 maps). This buffer prevents forced strategy abandonment during normal variance swings.

What's the relationship between EV and GPH?

EV is value per action; GPH is value per time. They're related by the formula: GPH = (60 × EV) / minutes_per_action. Maximizing EV while ignoring time often reduces GPH. The optimal strategy maximizes GPH, not EV. For comprehensive analysis, see our EV vs GPH optimization guide.

Which Path of Exile mapping route has the highest profit potential?

There's no universal "best" route—it depends on your build, juice budget, and preferred playstyle. Strand excels for speed farming with minimal juice. Cemetery dominates for divination card farming with medium juice. Crimson Temple works well for balanced strategies. Test multiple routes over 50+ map samples each and track your actual GPH—theoretical maximums mean nothing if you can't execute them.

Conclusion: Building Your PoE Currency Optimization System

Mastering Path of Exile currency mathematics isn't about memorizing formulas—it's about building systematic thinking that connects EV calculations to real-world GPH results. The players who consistently profit aren't necessarily the ones with the most complex spreadsheets; they're the ones who track results, adjust quickly, and optimize for the metrics that actually matter.

Core Principles for Sustainable Profit

- Optimize for GPH, not EV. Time is your scarcest resource—treat it accordingly.

- Track everything. You can't improve what you don't measure. Log costs, times, and returns.

- Reserve for variance. Positive EV doesn't mean positive results over small samples.

- Prioritize liquidity. Fast-selling loot beats higher-EV illiquid drops.

- Adjust constantly. PoE economy shifts weekly—last month's optimal strategy is this month's trap.

The frameworks in this guide provide the foundation, but execution separates profitable players from the rest. Start with one route, track 100+ maps, calculate your actual GPH, then iterate. For more Path of Exile optimization tools and related content across other games, explore our comprehensive loot calculator guide covering PoE, Diablo 4, WoW, and OSRS.

Related Reading

- Path of Exile Tools Hub — Currency calculators and profit optimization tools

- PoE Mapping & Stacked Deck Profit Guide — Detailed route analysis and strategies

- Drop Rate Math: EV, GPH & Variance — Statistical foundations for loot analysis

- EV vs GPH: Optimize Time — When to prioritize hourly income over per-action value

- Glossary — Definitions for variance, confidence intervals, and expected value